Grain in the Bank: Future Assurance

The warrantage inventory and credit system is a practical solution for small-scale farmers. It operates through a warehouse receipt mechanism, allowing farmers to store non-perishable crops (such as millet) in secure warehouses. In return, they receive inventory credit—loans against the stored grain. If farmers default, the grain is sold to recover the loan. This system provides several benefits: farmers gain from rising prices during scarcity, address urgent financial needs, pool resources for collective purchases, and engage in income-generating activities during the dry season. Implementation requires clean, secure warehouse facilities, equity injection for lending, and policy alignment to recognize agricultural produce as collateral. By minimizing risk and promoting financial inclusion, warrantage empowers smallholder families and strengthens rural economies.

This technology is TAAT1 validated.

Adults 18 and over: Positive high

The poor: Positive medium

Under 18: Positive high

Women: Positive high

Farmer climate change readiness: Significant improvement

The warrantage system is highly suitable for smallholder farming communities from Sub-Saharan Africa that lack favorable bank lending for agricultural investment. It’s important to note that the operational framework to implement a warrantage inventory credit system involves several key steps and requires the involvement of various stakeholders, including farmers, warehouse operators, and loan issuers. The system has been demonstrated and promoted in countries like Burkina Faso, Mali, and Niger with encouraging results.

Here are the steps of implementing a warrantage system:

90-kg hermetic bags

Open source / open access

Scaling Readiness describes how complete a technology’s development is and its ability to be scaled. It produces a score that measures a technology’s readiness along two axes: the level of maturity of the idea itself, and the level to which the technology has been used so far.

Each axis goes from 0 to 9 where 9 is the “ready-to-scale” status. For each technology profile in the e-catalogs we have documented the scaling readiness status from evidence given by the technology providers. The e-catalogs only showcase technologies for which the scaling readiness score is at least 8 for maturity of the idea and 7 for the level of use.

The graph below represents visually the scaling readiness status for this technology, you can see the label of each level by hovering your mouse cursor on the number.

Read more about scaling readiness ›

Uncontrolled environment: tested

Common use by intended users, in the real world

| Maturity of the idea | Level of use | |||||||||

| 9 | ||||||||||

| 8 | ||||||||||

| 7 | ||||||||||

| 6 | ||||||||||

| 5 | ||||||||||

| 4 | ||||||||||

| 3 | ||||||||||

| 2 | ||||||||||

| 1 | ||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ||

| Country | Testing ongoing | Tested | Adopted |

|---|---|---|---|

| Burkina Faso | –No ongoing testing | Tested | Adopted |

| Mali | –No ongoing testing | Tested | Adopted |

| Niger | –No ongoing testing | Tested | Adopted |

| Nigeria | –No ongoing testing | Tested | Adopted |

| Senegal | –No ongoing testing | Tested | Adopted |

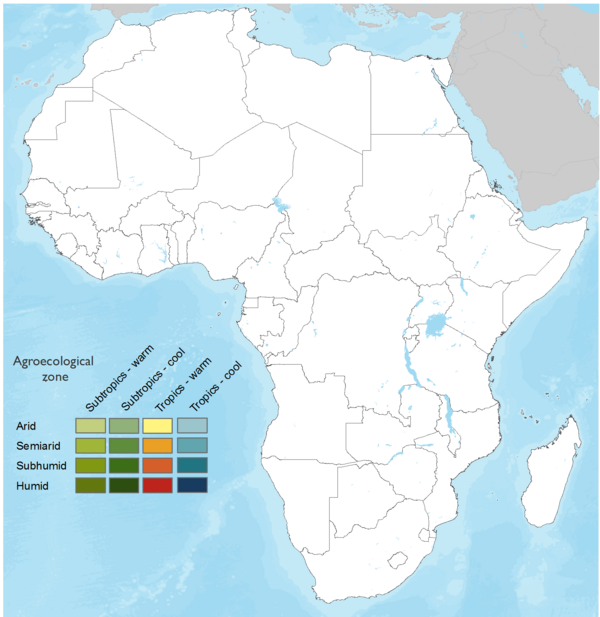

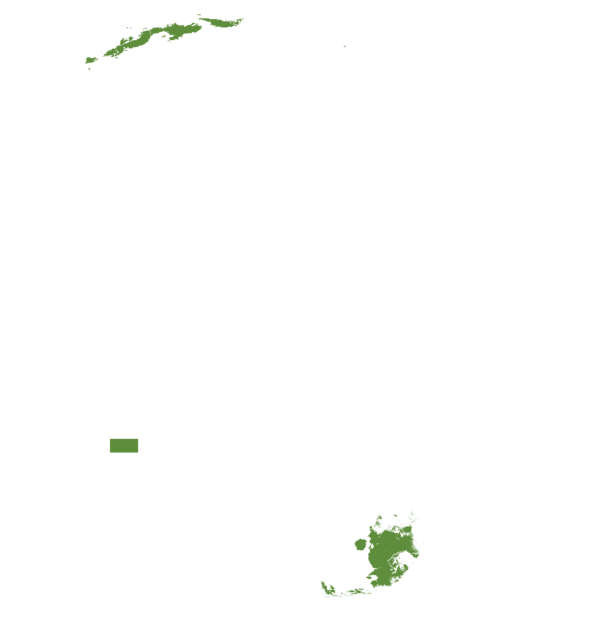

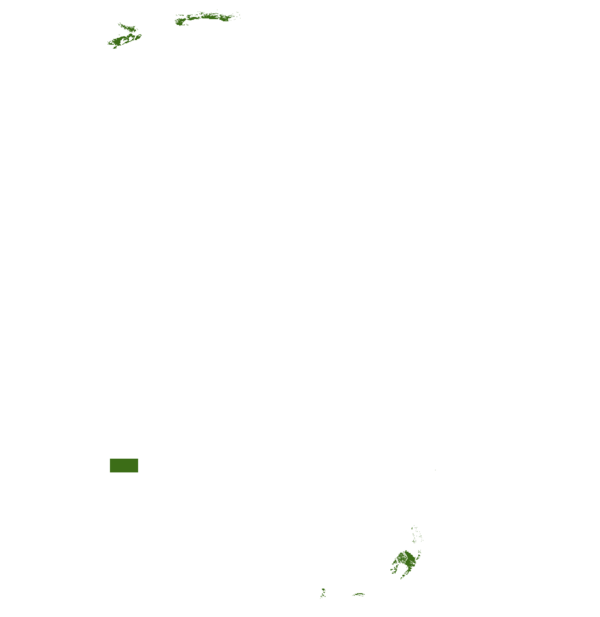

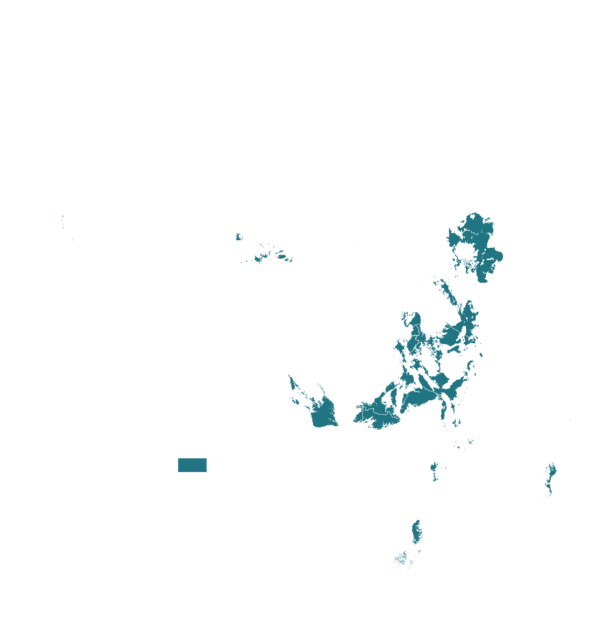

This technology can be used in the colored agro-ecological zones. Any zones shown in white are not suitable for this technology.

| AEZ | Subtropic - warm | Subtropic - cool | Tropic - warm | Tropic - cool |

|---|---|---|---|---|

| Arid | – | – | – | – |

| Semiarid | – | – | ||

| Subhumid | – | – | ||

| Humid |

Source: HarvestChoice/IFPRI 2009

The United Nations Sustainable Development Goals that are applicable to this technology.

Last updated on 7 November 2025